Highlights

(Hong Kong, 1 August 2022) — Xinyi Solar Holdings Limited (“Xinyi Solar” or the “Group”; stock code: 00968), the largest solar glass manufacturer in the world, today announced its interim results for the six months ended 30 June 2022 (“1H2022”). Despite high module prices and unresolved supply chain bottlenecks, the global photovoltaic (“PV“) installations continued to grow rapidly during the 1H2022, which has led to a significant increase in the demand for solar glass and thus absorbed the increase in the supply from the solar glass industry. By leveraging its increased production capacity and strong market presence, the Group achieved year-on-year (“YoY”) growth of 44.6% in sales volume in its solar glass segment in 1H2022, which partially offset the impact on solar glass segment performance brought by lower average selling prices (“ASP“) and higher raw material and energy costs.

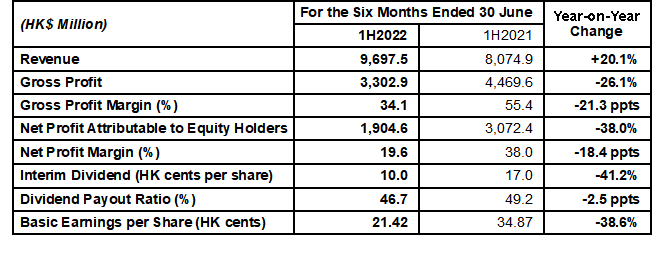

During 1H2022, the Group achieved consolidated revenue of HK$9,697.5 million mainly from its two core business segments of solar glass and solar farm, representing a 20.1% increase YoY. Gross profit was HK$3,302.9 million (1H2021: HK$4,469.6 million) and gross profit margin was 34.1% (1H2021: 55.4%). The Group recorded net profit of HK$1,904.6 million (1H2021: HK$3,072.4 million) with net profit margin of 19.6% (1H2021: 38.0%). Basic earnings per share were 21.42 HK cents (1H2021: 34.87 HK cents).

As at 30 June 2022, the Group’s financial position remained healthy, with cash and cash equivalents at HK$7,003.2 million (31 December 2021: HK$ 7,458.3 million). The Board of Directors has declared an interim dividend of 10.0 HK cents per share (1H2021: 17.0 HK cents). Dividend payout ratio for 1H2022 was 46.7% (1H2021: 49.2%).

Business Review

Solar Glass Business –

Capacity expansion to capture market growth, expand market share and mitigate the downward pressure on margins

The Group’s solar glass revenue increased by 22.6% year-on-year to HK$8,090.6 million in 1H2022, mainly due to higher sales volume, partially offset by lower ASP. Increased capacity and continued growth in downstream PV demand – albeit somewhat constrained by high solar module prices – drove the sales growth of the Group’s solar glass business in 1H2022.

The Group has accelerated its capacity expansion by adding four and three new solar glass production lines with a daily melting capacity of 1,000 tonnes each in 2021 and the 1H2022, respectively. In addition, two production lines with daily melting capacity of 900 tonnes, which had been undergoing cold repairs since November 2021, resumed commercial operations in April and June 2022. As at June 30, 2022, the Group’s total solar glass melting capacity reached 16,800 tonnes/day. As the new production lines have adopted advanced designs and production techniques, they not only expanded the Group’s scale of operation, but also enhanced the overall production efficiency and cost advantages of the Group.

As for the product mix, the Group has continued to further develop the thin glass and large-format glass market so as to maintain its industry leadership and focus on niche areas in which it enjoys strong competitive advantages. During the 1H2022, the Group’s thin glass and large-format glass sales continued to increase, as double-glass, bifacial and high-power modules became increasingly popular.

Besides, as an industry leader and a socially responsible company, the Group has continued to strengthen its efforts in energy saving and emission reduction. The Group has already completed the hearing process for its solar glass expansion projects in five different provinces in the PRC. With its consistent leading edge in technological innovation, energy conservation and emission reduction, the Group has an advantage in obtaining new capacity quotas.

Solar Farm Business –

Steady growth of contribution from solar power generation

The total electricity generated from the Group’s solar farm portfolio grew steadily in 1H2022, primarily due to the capacity added in 2021. During 1H2022, revenue and gross profit of the Group’s solar farm business increased by 5.5% and 4.1% year-on-year, respectively.

High module prices, mandatory energy storage requirements, land availability and quarantine restrictions have affected the Group’s new solar farm development in 1H2022. Due to the increase in technical and non-technical costs, the Group has postponed the construction work of its self-developed solar farm projects to balance the risks and rewards. In 1H2022, the Group had two solar farm projects newly connected to the grid, including a 2 megawatts (“MW“) rooftop distributed generation project developed by its own EPC team and a 40MW ground-mounted project acquired by Xinyi Energy Holdings Limited (“Xinyi Energy“) and its subsidiaries (collectively, the “Xinyi Energy Group“) from an independent third party.

As at 30 June 2022, the accumulated approved grid-connected capacity of the Group’s solar farm projects was 4,115MW, of which 3,884MW was for utility-scale ground-mounted projects and 231MW was for rooftop distributed generation projects. In terms of ownership, solar farm projects with a capacity of 2,534MW were held through Xinyi Energy Group, a subsidiary owned as to 48.76% by the Group; solar farm projects with a capacity of 1,481MW were held through wholly-owned subsidiaries of the Group; and a solar farm project with a capacity of 100MW was held by a joint venture in which the Group has 50% ownership.

Prospect

Amid the worldwide acceleration of energy transition and carbon reduction to address climate change, with years of technological advances and cost reductions, solar energy has already become the most important renewable energy source, and its annual incremental share has greatly exceeded that of other renewable energy sources. However, solar energy only accounted for about 4% of global electricity consumption in 2021. It has great potential for further development in the future. Meanwhile, the deepening of the regional energy crisis may bring changes to the energy policies of some countries, aiming to reduce the dependence on external energy supply and mitigate the impact of rising fossil fuel prices, which will increase the demand for solar power generation.

The Group will continuously expand its solar glass production capacity so as to enlarge its market share and sustain further growth. The Group plans to add eight new solar glass production lines in 2022, each with a daily melting capacity of 1,000 tonnes, four of which are located in Zhangjiagang, Jiangsu Province, and another four are located in Wuhu, Anhui Province. Furthermore, the Group has in its pipeline the construction of twelve new solar glass production lines, of which eight lines (with a daily melting capacity of 1,000 tonnes each) are to be located in Wuhu, Anhui Province, two lines (with a daily melting capacity of 1,200 tonnes each) are to be located in Qujing, Yunnan Province, and two lines (with a daily melting capacity of 1,200 tonnes each) are to be located in Malaysia. The Group will monitor the future geographical distribution of production capacity of major solar module manufacturers and make strategic deployment of new solar glass production capacity in the PRC and overseas accordingly.

In order to better cope with the competition arising from increased industry supply, the Group will continue to pursue excellence in production processes, product differentiation and innovation by expanding, upgrading and improving its solar glass production facilities, enhancing production efficiency and optimising product mix to boost sales of value-added products such as thin glass and large-format glass, thereby effectively mitigating the pressure on margins due to rising costs and maintaining its leading position in the industry.

As for the solar farm business, the Group will further explore development opportunities in different regions of China so as to strengthen its project pipeline. As the implementation schedule of new solar farm projects in the second half of 2022 may still be affected by factors such as solar module prices, land availability and mandatory storage and other policy requirements, the capacity of new solar farm projects to be added by Group in 2022 will be likely lower than the original target of 720MW, and the Group will make flexible adjustments according to market conditions and the specific circumstances of each project.

Regarding the construction of a 60,000 tonnes/year polysilicon production facility in Qujing, Yunnan Province, the preparatory work for the project is progressing well, and it is expected to start operation in the second half of 2023 ahead of schedule.

Dr. LEE Yin Yee, B.B.S., Chairman of Xinyi Solar, said, “In light of global inflationary pressure, rising raw material and energy prices and uncertain market conditions, the Group will relentlessly focus on improving production efficiency, effective cost control and product innovation to further strengthen its competitive edge. The Directors believe that the Group will continue to enjoy the benefits of further industry expansion, strong downstream demand and its own economies of scale. With solid business foundation and strong management execution capabilities, the Group will be able to navigate through different market cycles and facilitate the continued growth of its solar glass and solar farm businesses.”

# # #

[ad_2]

Disclosure:

It can be assumed that parties associated with thegreeneconomynews.com have long stock, option or similar derivative positions in any and/or all companies mentioned on this website. Disclaimer

Message from The Green Economy News:

If you’d like to invest in many of the companies featured on thegreeneconomynews.com you can use eToro’s CopyTrader feature and invest in an ESG Portfolio of companies with The Green Economy News curator @Tom1313 , capital at risk. Alternatively if you found this content useful, consider supporting our work and Buy us a coffee!.