Highlights

(Hong Kong, 27 February 2023) — Xinyi Solar Holdings Limited (“Xinyi Solar” or the “Group“; stock code: 00968), the world’s largest solar glass manufacturer, today announced its annual results for the year ended 31 December 2022 (“FY2022” or the “Year“). Against the backdrop of strong growth in global PV installations and thus surge in solar glass demand, the Group achieved remarkable rise in solar glass sales volume and revenue during the Year by leveraging its expanded capacity and flexible marketing strategies.

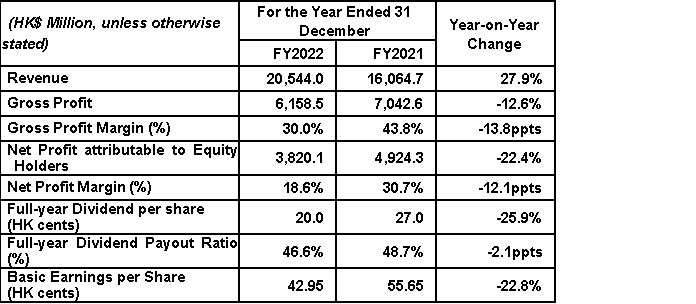

During FY2022, the Group achieved consolidated revenue of HK$20,544.0 million, representing an increase of 27.9% year-on-year (“YoY”). Gross profit stood at HK$6,158.5 million (FY2021: HK$7,042.6 million), with gross profit margin of 30.0% (FY2021: 43.8%). The decrease in gross profit margin was mainly due to the lower average selling price (“ASP”) and higher procurement costs of the solar glass segment, and a revenue reduction in the solar farm business resulting from the deduction of tariff adjustment (subsidy) receivables. Meanwhile, net profit reached HK$3,820.1 million (FY2021: HK$4,942.3 million). Basic earnings per share were 42.95 HK cents (FY2021:55.65 HK cents).

As of 31 December 2022, the Group maintained a healthy financial position, with cash and cash equivalents at HK$5,325.7 million (31 December 2021: HK$7,458.3 million). The Board of Directors proposed the payment of a final dividend of 10 HK cents per share (FY2021: 10.0 HK cents). The dividend payout ratio for the Year was 46.6% (FY2021: 48.7%).

Business Review

Solar Glass Business –

Strong Revenue Growth Driven by Sales Volume Increase and Sales Mix Optimisation

Product Portfolio Enhancement and Capacity Expansion to Meet Market Demands

The Group’s revenue from sales of solar glass surged by 35.6% YoY to HK$17,655.1 million, mainly attributable to the increase in sales volume and sales mix optimisation, despite the drop in ASP as a result of intense industry competition. Leveraging its increased capacity and flexible marketing strategies, the Group’s total solar glass sales volume (in terms of tonnage) grew by 44.4% YoY in FY2022.

Given that global PV installation has entered a new phase of rapid development, the Group has accelerated the pace of its capacity expansion to capture new market opportunities and reinforce its leading market position. By adopting advanced design and production technologies, the new production lines not only expanded the Group’s scale of operation, but also enhanced its overall production efficiency and cost advantages.

During the Year, the Group added six new solar glass production lines with a daily melting capacity of 1,000 tonnes each, compared to four new solar glass production lines with a daily melting capacity of 1,000 tonnes each in FY2021. In addition, two production lines with a daily melting capacity of 900 tonnes each resumed operations in April and June 2022, respectively, after cold repairs that began in November 2021. As at 31 December 2022, the Group’s total solar glass melting capacity reached 19,800 tonnes per day.

As for product mix, the proportion of thin glass sales in the Group’s total solar glass sales increased significantly, especially in the second half of the Year, which helped to mitigate the pressure on gross profit margins caused by rising raw material and energy costs.

Solar Farm Business –

Continuous Increase in Grid-connected Capacity

Accelerated Renewable Energy Power Generation Subsidy Collection to Boost the Cash Flow

With regard to the solar farm business, the total electricity generated from the Group’s solar farm portfolio grew steadily during the Year, primarily due to the new capacities completed or acquired. As at 31 December 2022, the cumulative approved grid-connected capacity of the Group’s solar farm projects was 4,879 megawatts (“MW”), of which 4,566MW was for utility-scale ground-mounted projects and 313MW was for rooftop distributed generation projects with electricity generated for self-consumption or for sale to the grid.

Supported by the new capacities added or acquired, revenue before taking into account the deduction of tariff adjustment (subsidy) receivables from the solar farm segment grew steadily by 8.7% to HK$3,086.2 million in FY2022. After taking into account of the deduction of tariff adjustment receivables, revenue from this segment dropped by 3.3% YoY. On 8 and 28 October 2022, the “Notice on clarification of policy interpretation with regards to verification of eligibility for the renewable energy power generation subsidy (《關於明確可再生能源發電補貼核查認定有關政策解釋的通知》)” (the “Notice”) and the”Announcement on publishing the List of the first batch of renewable energy generation subsidy compliant projects (《關於公佈第一批可再生能源發電補貼合規項目清單的公告》)” (the “First Qualified Project List”) were issued by the relevant PRC regulatory authorities. The Notice specified more detailed requirements/guidance in the examination and verification works relating to the tariff adjustment (subsidy) receivables of renewable energy projects. As at 31 December 2022, the Group held subsidised solar farm projects with a total approved capacity of 2,164 MW, of which 1,234 MW was included in the First Qualified Project List. Considering the implications of the Notice and the First Qualified Project List and the collection progress of the tariff adjustment receivables up to 31 December 2022, and for the sake of prudence, the Board of Directors consider that it would be necessary to reduce the amount of tariff adjustment receivables as of 31 December 2022 by HK$341.8 million.

The Group completed the grid connection of six projects with an aggregate approved capacity of 392 MW in FY2022, of which 352MW was utility-scale ground-mounted projects and 40MW was for commercial and self-used distributed generation projects. Together with 414MW solar farm projects added by Xinyi Energy Holdings Limited (“Xinyi Energy” and its subsidiaries, collectively “Xinyi Energy Group”) from third parties in 2022, the Group’s newly-added approved capacity for the year was 806MW.

The Group completed the transfer of solar farm projects with a capacity of 150MW to Xinyi Energy Group in December 2022 under the business delineation requirement, which faclitated the Group to recover available funds.

In terms of ownership, solar farm projects with a capacity of 3,058MW were held through Xinyi Energy Group; solar farm projects with a capacity of 1,721MW were held through wholly-owned subsidiaries of the Company; and a solar farm project with a capacity of 100MW was held by an entity owned as to 50% by the Group.

Other Updates –

Polysilicon Production Project

Regarding the project to construct a 60,000 tonnes per year polysilicon production facility in Qujing, Yunnan Province, the preparation and preliminary construction works are in progress as planned. Trial production is expected to commence around the end of 2023.

Prospects

With continuous technological advances and significant improvements in power generation efficiency, solar energy has gradually developed into a major source of newly-added electricity generation capacity across the globe as countries are striving to move towards carbon neutrality. Rising energy prices and the energy crisis triggered by geopolitical tensions will further underscore the competitive advantage of solar energy. Given that solar power still only accounts for a small proportion of global electricity generation, huge room for development is anticipated in the years to come.

Meanwhile, the easing of polysilicon supply bottleneck is expected to help drive the cost of PV installation back to a downward trajectory and thus further stimulate the release of downstream demand. As the increase in downstream PV installations will continue to drive growth in demand for solar glass, the Group will actively expand its solar glass production capacity in an orderly manner so as to sustain further growth and enlarge its market share.

The Group targets to add seven new production lines with a total daily melting capacity of 7,000 tonnes in 2023, thereby increasing its total solar glass daily melting capacity from 19,800 tonnes at the end of 2022 to 26,800 tonnes at the end of 2023.

On the supply side of solar glass, the industry’s total capacity is expected to grow further in 2023 amid rapid growth in downstream demand. The increase in supply will inevitably lead to a more competitive market environment and greater pressure on profit margins for industry players. In order to reinforce its leading position, the Group will continue to pursue excellence in production processes, product differentiation and innovation by expanding, upgrading and improving its solar glass production facilities, enhancing production efficiency and optimising product mix to further develop the market for high value-added products such as thin glass and large-format glass, thereby effectively alleviating the pressure on profit caused by rising procurement costs and enhancing its competitive edge.

As for the solar farm business, the Group will further explore development opportunities in different regions of China so as to strengthen its project pipeline. However, in view of an environment of heightened geopolitical tensions, high inflation, rising interest rates, declining economic growth expectations and more restricted land supply, the Group will take a more cautious approach to new investments in solar farm projects and flexibly adjust its investment strategy based on the market condition and the specific circumstances of each project. The Group’s self-developed solar farm project target for 2023 would be in the range between 500MW to 800MW.

Dr. LEE Yin Yee, B.B.S., Chairman of Xinyi Solar, concluded, “In light of the more competitive market environment, the Group will relentlessly focus on improving efficiency, enhancing cost control and product differentiation to further strengthen its competitive edge. Despite the complex and rapidly changing market environment, we believe that the Group will continue to enjoy the benefits of industry expansion, growth in downstream demand and its own economies of scale. With its solid business foundation, strong management execution and sound financial position, the Group is confident to navigate through different market cycles and devlier continued growth of its solar glass and solar farm businesses.”

# # #

[ad_2]

Disclosure:

It can be assumed that parties associated with thegreeneconomynews.com have long stock, option or similar derivative positions in any and/or all companies mentioned on this website. Disclaimer

Message from The Green Economy News:

If you’d like to invest in many of the companies featured on thegreeneconomynews.com you can use eToro’s CopyTrader feature and invest in an ESG Portfolio of companies with The Green Economy News curator @Tom1313 , capital at risk. Alternatively if you found this content useful, consider supporting our work and Buy us a coffee!.